Whole Life Insurance offers guaranteed premiums that will not increase throughout one’s lifetime. Within Whole Life, you have the option of paying your premium throughout different time intervals. By paying up in a shorter term, you end up spending fewer total dollars. How much less? Read our blog comparing a 20 Pay vs Paid Up at Age 100 for a $1 million Death Benefit.

Whole Life is a permanent type of life insurance policy that offers a fixed, typically guaranteed, premium and death benefit, with the only condition being that premium payments are made in full and on time. There is a myriad of different ways to pay premiums for a Whole Life policy. Some alternatives are 10 Pay (where you only pay a premium for the first 10 years), 20 Pay (where you only pay a premium for 20 years), Paid-Up at Age 65 (where you pay premium up till Age 65), and Paid-Up at Age 100 (where you pay a premium up till Age 100). These are some of the more common options, but there are other alternatives out there as well. These alternatives give you the option to design your premium payments to suit your needs. Perhaps you would not like to pay premiums after you retire. In that case, shorter premium schedules are more suitable. This article will give you an outline of the tradeoffs you make by getting a 20 Pay versus Paid Up at Age 100 policy.

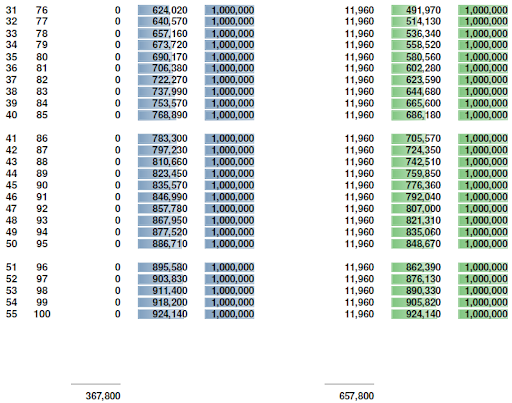

Example:

Sex: Female

Age: 45

State: CA

Risk Class: Preferred Non-Smoker (2nd Best Rating)

Guaranteed Death Benefit: $1,000,000

Premium Payment Mode: Annual

Comparison: 20 Pay vs Paid Up at Age 100

In the short run, this woman saves about $6,500 a year by going with the Paid Up Age 100 option. However, in the long run, total premium payments for the Paid Up Age 100 are almost double should the insured woman live to be 100 years of age.

In the Paid Up Age 100, the insured surpasses the amount of total premium paid in the policy’s 31st year. Hence, if the woman expects to live past age 76, then if financially possible, the 20 Pay would be the more economically sound option.

At the end of the day, the choice is yours. This article is simply made to be informational. Are you interested in Whole Life? Contact us today!

(559) 322-2230

Comments